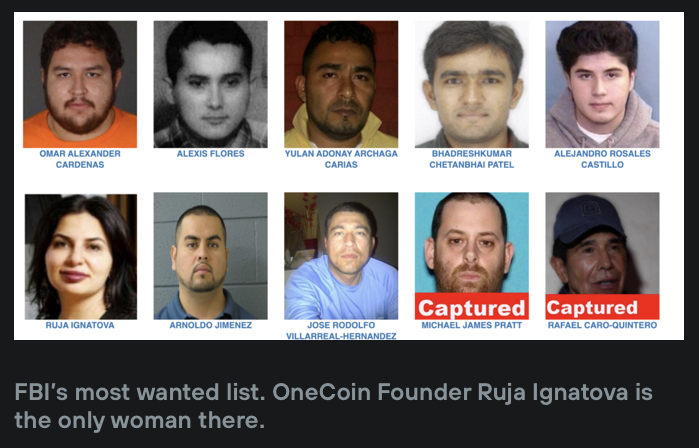

After 72 years of the FBI’s most wanted list, only 11 women have been featured on it – from political activists like Angela Davis to the notorious Ruja Ignatova.

The latter, known as the Crypto Queen, is alleged to have defrauded wealthy investors of $4 billion between 2014 and 2016 through her company OneCoin, a Ponzi scheme.

In 2017 Ignatova vanished, with US authorities charging her with wire fraud, securities fraud, and money laundering in 2019, even in her absence.

Recently, the FBI has upped the ante in their search for Ignatova – offering a $100,000 reward for any information leading to her capture while speculating that the fugitive might have changed her appearance through plastic surgery or other means.

But, in a shocking twist of events, it’s been revealed that Ignatova attempted to sell her £11 million London penthouse – potentially unmasking her whereabouts in the process.

Now, the questions remain: what was OneCoin, who is Ignatova, and what is the controversy around it?

OneCoin scam: a brief story

The saga of OneCoin began in 2014 when Ruja Ignatova founded it.

OneCoin was pitched as the world’s first blockchain-based, 100% open-source cryptocurrency. It promised to be the next bitcoin (BTC) – a true people’s currency – with the potential to become a global, cashless system. But then something happened on the way to this goal.

It turns out that OneCoin wasn’t a cryptocurrency at all. It was a pyramid marketing scheme where members were encouraged to buy coins and recruit more people to do the same.

The people at the top of the pyramid were made out like bandits, while everyone else was left holding the bag. OneCoin’s market had no liquidity. You couldn’t buy or sell or even transfer your currency. The only way to cash out was to convert it to another currency or ask Ignatova.

The first red flag came when a third-party audit on the currency’s blockchain technology was announced and abruptly canceled. This spurred national investigations and made it increasingly clear that the project was indeed a scam.

OneCoin was finally shut down in 2017 after years of controversy and allegations of being a scam. The asset, which promised investors massive returns of up to 18,000%, certainly lived up to the infamous tagline, “If it’s too good to be true, it probably is.”

The curious tale of Ruja Ignatova

They say that money makes the world go round, but when it comes to Ruja Ignatova, the world went from round to round the bend.

The Bulgarian-born businesswoman and entrepreneur dubbed the Crypto Queen had a meteoric rise as the head of an international cryptocurrency company, OneCoin – and an equally dramatic fall when it was discovered to be a multi-billion dollar Ponzi scheme.

Ruja Ignatova held a series of impressive degrees and is a self-described polymath. Many were swept away by her charisma and black-and-white vision of a future where cryptocurrency would revolutionize the way money works.

But Ruja Ignatova turned out to be a master scammer and fraudster. Her company, OneCoin, was a classic Ponzi scheme, where returns were paid to earlier investors with the money of later ones.

In the process, Ignatova pocketed hundreds of millions of dollars of the investors’ money, and when the scam was exposed, she disappeared, leaving the investors with huge losses.

Some investigators believe that Ignatova may have laundered the money through offshore accounts, while others think she may have escaped to a remote island in the Caribbean – though no one knows for sure. She traveled from Sofia, Bulgaria, to Athens, Greece, on Oct. 25, 2017, and has not been seen since.

In March 2019, the US Department of Justice charged her with securities fraud and money laundering, but she remains at large.

Whether Ruja Ignatova is on the run or just enjoying her ill-gotten gains, one thing is certain. Her story is a cautionary tale about the risks of investing in unregulated cryptocurrencies and a reminder of the need to scrutinize any venture that purports to be a surefire investment.

Who is Crypto Queen, the only woman on FBI’s most wanted list – 2

Ruja Ignatova’s profile by FBI

OneCoin investigation

Jamie Bartlett and his investigative team on the UK’s BBC have been intently following OneCoin since this massacre occurred in 2019.

To chronicle their efforts in tracking down the crypto schemes’ notorious leader, Ignatova, they released a riveting podcast series titled “The Missing Crypto Queen,” which featured nine episodes of insightful yet inconclusive information.

Bartlett and his team uncovered convincing evidence that OneCoin was more than just another pyramid scheme. They discovered Ignatova was associated with influential and potentially dangerous actors in Eastern European organized crime. This groundbreaking work prompted the FBI to finally add Ignatova to their Most Wanted list in late June 2022.

As of late September 2022, the BBC team returned to the hunt with an unexpected source of evidence: documents indicating that Ignatova was involved in a cryptocurrency laundering operation with a royal from the United Arab Emirates to release confiscated money and the purchase of a $20 million villa in the UAE.

Yet, more surprisingly, the investigative team found proof that specific figures in the Bulgarian government were assisting OneCoin in staying one step ahead of the law.

The capacity of financial criminals to draw in influential people, especially mobsters and corrupt government officials, is a frightening consequence of the ever-expanding digital financial world.

In December 2022, Frank Schneider, the crisis manager of OneCoin, was hit with an extradition notice from the U.S. Department of Justice. If found guilty of the alleged charges of wire fraud and money laundering, he could face up to 40 years in an American prison.

Adding insult to injury, Karl Sebastian Greenwood, a co-founder of OneCoin and associate of its founder, Ruja Ignatova, decided to throw in the towel and pleaded guilty in the Manhattan Federal court on Dec. 16, 2022.

It didn’t come as a surprise as federal prosecutors have been pressuring Greenwood to cooperate in their extensive investigation into the $4 billion cryptocurrency Ponzi scheme.

It remains to be seen what consequences will befall Schneider, Greenwood, and the rest of the team behind the scam.

Ignatova: on the loose and out of sight

A lavish London penthouse that Ignatova allegedly owns is now up for sale with an asking price of around £11 million ($13.6 million).

The property, located in the capital, is thought to have been used by Ignatova as an occasional hideaway in 2016 and is believed to have been visited by those connected with the OneCoin cryptocurrency business.

The penthouse is owned by the Abbots House Penthouse Limited, an anonymous shell company registered in the secretive tax haven of Guernsey, meaning that Ignatova’s name does not appear on official land registry deeds or in public records.

The property is being marketed for sale by Knight Frank, a British real estate consultancy. Speaking to inews, investigator Jamie Bartlett from BBC described the listing of the London penthouse as “one of the most interesting developments” in the OneCoin story.

He suggested that Ignatova is still alive and that there may be vital clues as to her current whereabouts hidden within documents associated with the property. Bartlett added that the property sale might provide an opportunity for the authorities to freeze the asset and help victims recoup money lost in the scam.

How to detect a Ponzi scheme

Crypto Ponzi schemes have become increasingly popular in recent years, and it’s easy to fall victim to them if you’re not careful.

Here are some tips to help protect yourself from becoming a victim of a crypto Ponzi scheme:

- Do your research: Before investing in any crypto-related venture, make sure you do your due diligence. Research the project, read reviews and ensure you understand the project. Don’t just rely on what you hear from the project’s promoters.

- Beware of unrealistic promises: If a crypto project promises extremely high returns (in a short period) with minimal risk, it’s probably too good to be true. Be very wary of promised returns that seem too good to be true.

- Avoid high-pressure tactics: If a project tries to pressure you into investing, it’s a major red flag. Nobody should be forcing you to invest in anything. If something feels off, trust your intuition and take a step back.

- Look for transparency: A reputable project will be transparent with its finances, have an active development team, and have a well-thought-out roadmap for its future. If a project lacks in any of these areas, it’s likely a sign that the project is a scam.

- Don’t fall for FOMO: The fear of missing out (FOMO) can be a powerful emotion, but don’t let it cloud your judgment when it comes to investing. Don’t rush into a decision before you’ve done your research, and never invest more than you can afford to lose.

Following these tips might help you protect yourself from crypto Ponzi schemes, allowing you to make better investment decisions and keep your hard-earned money safe.