The SEC has voiced worry about investors being given a false sense of security.

A number of cryptocurrency exchanges have advocated publishing evidence of reserves.

Audit firms doing crypto company audits may expect heightened attention from the U.S. Securities and Exchange Commission (SEC). The SEC has voiced worry about the possibility of investors being given a false sense of security by auditing reports, increasing their vulnerability to cryptocurrencies.

This comes after a number of cryptocurrency exchanges have advocated publishing evidence of reserves. To reassure clients that their money is secure and the company is solvent.

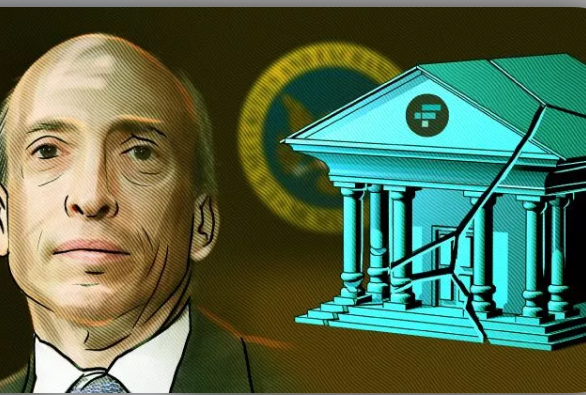

Moreover, the SEC’s anti-crypto attitude persists, and the agency has vowed to increase its scrutiny of financial institutions that do business with cryptocurrency firms. The SEC is now scrutinizing the manner in which crypto companies provide audit firm reports.

Audit Firms Now Hesistant

Due to regulatory pressure, banks and auditing firms are hesitant to cooperate with crypto startups. France’s Mazars has previously suspended services to cryptocurrency exchanges like Binance and Crypto.com due to increased scrutiny on audit companies. The accounting company even went so far as to delete Binance’s proof of reserves report from its website.

SEC Chair Gary Gensler said that investors face crypto risks unless crypto businesses comply with traditional securities regulations in reaction to the agency’s fraud allegations against former Alameda CEO Caroline Ellison and FTX co-founder Gary Wang. The SEC is committed to continuing its efforts to bring the cryptocurrency sector into compliance via the use of all appropriate instruments.

Warnings are being issued by the SEC to audit companies doing crypto audits. The oversight body thinks crypto exchanges are taking advantage of audit companies’ proof of reserves reports. Further, it provides insufficient financial information to determine whether the company’s assets are adequate to meet its obligations.