Grayscale’s website states that GBTC has $11.9 billion in assets under management.

GBTC has always traded at a significant premium over spot Bitcoin pricing.

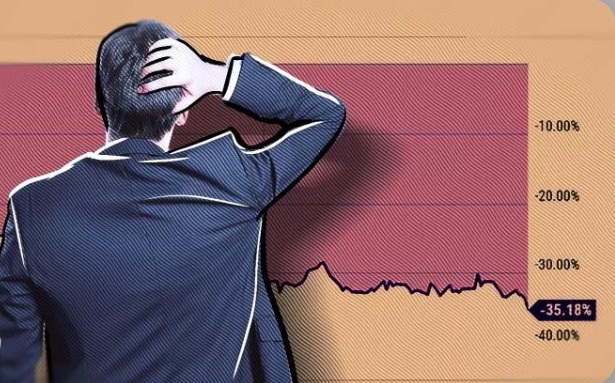

Shares of the Grayscale Bitcoin Trust (GBTC), the biggest Bitcoin fund in the market, reached a record discount of 35.18% last Friday and showed little sign of recovering.

By purchasing GBTC shares, investors may get exposure to the fluctuating value of Bitcoin by trading in shares of trusts that hold pools of Bitcoin. The goal is to reduce the risk for institutional investors by providing exposure to the main cryptocurrency without requiring them to purchase and hold any coin.

GBTC has been around since September of 2013 and has always traded at a significant premium over spot Bitcoin pricing. Despite the high 2% annual management charge, this was a popular choice among investors for a long time.

GBTC Cannot Be Redeemed

After the introduction of multiple Bitcoin ETFs in Canada at the end of February last year, the trust became negative and started trading at a discount to spot Bitcoin values. The ability to purchase Bitcoin “shares” at a discount to the NAV may seem like a steal to investors. But there’s a catch: GBTC can’t be exchanged for anything at the moment.

This effectively puts an end to the arbitrage transaction in which cheap shares are purchased, redeemed for the actual asset, and then sold for a profit.

Grayscale’s website states that GBTC has $11.9 billion in assets under management at the present time. Grayscale has long argued that the ideal solution is to transform its GBTC product into a Bitcoin ETF—an exchange-traded fund backed by actual Bitcoin.

However, the business is hampered by the fact that the U.S. Securities and Exchange Commission (SEC) has not yet authorized a spot Bitcoin ETF for American investors while having approved a number of Bitcoin futures ETFs.