This is the first of many planned big updates for Ethereum.

Switching from proof-of-work to proof-of-stake was not easy task.

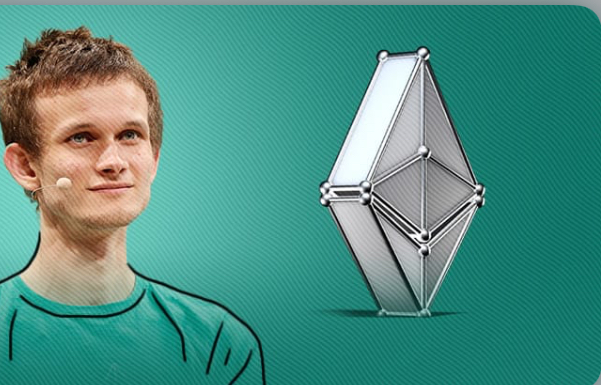

Years of planning and delays have resulted in the successful completion of the Merge, a significant makeover of Ethereum that will move the network at the heart of the second-largest cryptocurrency to a considerably more energy-efficient system. Switching from proof-of-work to proof-of-stake, two competing methods for maintaining a blockchain, was no easy task.

The switch to proof of stake, symbolized by the merge, was a major event for Ethereum. For consensus in the past, the network employed the same proof of work system as Bitcoin. This kind of network security consumes enormous amounts of electricity. Enough to power whole nations to process new transactions on the network.

The possible benefits are enormous. Hopefully, Ethereum’s energy use has dropped by almost 99.9 percent. Moreover, one assessment compares the impact on energy prices to if Finland abruptly disconnected its electricity system.

This is the first of many planned big updates for Ethereum, all of which will help the network expand to accommodate much more transactions at a cheaper cost and with a smaller total storage footprint.

Developers for Ethereum, which hosts a $60 billion ecosystem of cryptocurrency exchanges, lending platforms, non-fungible token (NFT) markets, and other applications, claim that the update will make the network safer and more scalable.

A Lot More to Come

Ethereum, whose ether (ETH) token has a market value of close to $200 billion at present, is the second-largest cryptocurrency behind bitcoin (BTC), and the concept that it will make this changeover was there from the outset. However, the change required a complex technological effort, and it was a dangerous venture that many people questioned whether or not it would succeed.

At 2:43 a.m. EST, when the Merge began, nearly 41,000 individuals were watching a livestream on YouTube called “Ethereum Mainnet Merge Viewing Party.” Moreover, they waited anxiously as important indicators poured in. Indicating that validators, Ethereum’s new proof-of-stake network administrators, were performing as anticipated and adding new transactions to the blockchains ledger. Furthermore, the Merge “finalized” after around 15 minutes of waiting, at which point it could be considered successful.

Market Sentiment Gloomy

Crypto investors, enthusiasts, and doubters alike have been keeping a close eye on the upgrade, which would reduce the network’s dependence on the energy-intensive process of cryptocurrency mining, because of the ripple effects it is projected to have on the broader blockchain sector.

ETH saw a 24-hour loss of around 0.81%, trading at $1,594 in the minutes after the Merge. Because it included dozens of teams and hundreds of researchers, engineers, and volunteers, the upgrade was especially difficult because it was perhaps the biggest open-source software project ever attempted.

The merging may not instantly impact market sentiment. Since investors have been shifting out of riskier assets. Including those that are meant to function as a buffer against inflation. The Ethereum Merge shouldn’t be seen as an isolated occurrence. But rather as one step in Ethereum’s bigger, continuing growth, say the experts.

The shift to proof-of-stake (PoS) is a watershed event for Web3 since it reduces climate concerns, which should encourage additional layer-1s to do the same and removes a major obstacle to widespread adoption of Web3 and crypto.