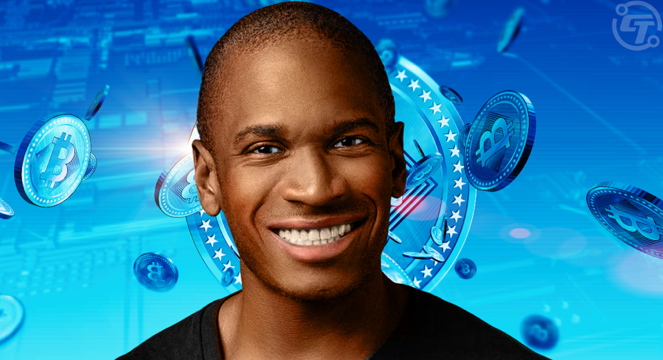

Bitcoin is on the rise, it rose 3.5% to $87,000, before the US core PCE data is released this week. Arthur Hayes, the ex-CEO of BitMEX, has high expectations for BTC and anticipates that it will surge to $110,000 and then drop to $76,500.

Arthur Hayes believes this price surge is fueled by the Federal Reserve’s expected shift from quantitative tightening (QT) to quantitative easing (QE).

Currently, it is trading at $87,007 with a 3.28% increase in its value while the daily trading volume has increased to $16.69 billion, a 74% increase. The same can be observed in the BTC futures market where open interest rose by 7.79% to more than $56 billion.

In the week ahead, the focus is on the US core PCE price index for February, which is a measure of inflation. Experts expect it to rise slightly from 2.6% to 2.7%, which may affect the market’s attitude towards risk assets, including Bitcoin.

On the other hand, the demand from institutions is gradually increasing. The US spot Bitcoin ETFs have remained popular and have been experiencing inflows, and corporate investors such as MicroStrategy and Metaplanet are still accumulating more BTC.

Metaplanet has recently acquired 150 Bitcoin and thus has increased its Bitcoin balance to 3,350 BTC. With such institutional interest, the bullish run of Bitcoin may still be in its early stages.