The global economy faces heightened uncertainty following former President Donald Trump’s recent announcement of tariffs on goods from Canada and Mexico, sparking debates among experts about navigating the potential fallout. On January 31, Trump declared plans to impose 25% tariffs, set to take effect February 1, with analysts warning of cascading effects such as inflationary pressures and disruptions to global trade. Critics emphasize that consumers may bear the brunt of rising costs, while retaliatory measures from other nations could further destabilize economic activity.

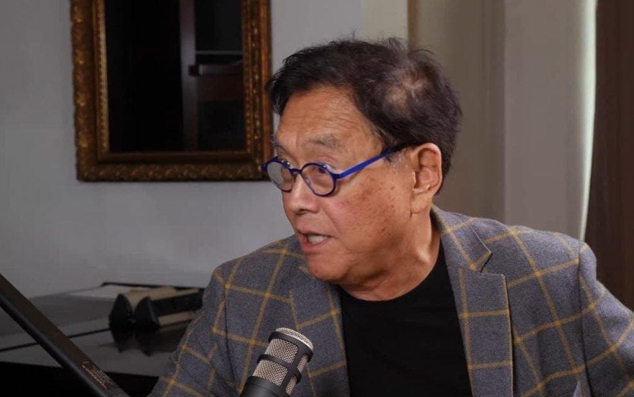

Amid the turmoil, renowned investor and author Robert Kiyosaki, best known for “Rich Dad Poor Dad”, outlined a contrarian approach to turning market volatility into a wealth-building opportunity. In a February 1 social media post, Kiyosaki suggested that Trump’s tariffs could trigger short-term crashes in assets like gold, silver, and Bitcoin (BTC). Rather than viewing this as a setback, he framed it as a strategic moment for investors to acquire undervalued assets.

“TRUMP TARIFFS BEGIN: Gold, silver, Bitcoin may crash. GOOD. Will buy more after prices crash. Real problem is DEBT… which will only get worse. CRASHES mean assets are on sale. Time to get richer,” he wrote.

Interestingly, current market trends partially contradict Kiyosaki’s short-term predictions. Gold, for instance, has surged to record highs, approaching the $3,000 mark as investors seek safe-haven assets amid geopolitical and economic uncertainty. Bitcoin, meanwhile, has experienced mild consolidation above the $100,000 level, though analysts maintain a bullish long-term outlook for the cryptocurrency.

Kiyosaki’s commentary aligns with his longstanding advocacy for alternative investments as hedges against economic instability. He has repeatedly urged investors to diversify into assets like Bitcoin, gold, and silver, arguing that traditional fiat currencies—particularly the U.S. dollar, which he labels “fake money”—are headed for collapse. His bold forecasts include Bitcoin potentially soaring to $500,000 in the coming months, driven by a loss of confidence in government-backed currencies.

As markets react to shifting trade policies and macroeconomic pressures, Kiyosaki’s perspective underscores a broader philosophy: embracing volatility as a gateway to opportunity rather than a threat. Whether his predictions materialize remains uncertain, but his emphasis on strategic asset accumulation during downturns continues to resonate with investors preparing for an unpredictable economic landscape.