When trading cryptocurrencies, understanding the various order types is crucial for executing your strategies effectively and managing risk.

Some common order types in trading.

Market Order

Execution: Immediately buys or sells at the best available price in the market.

Pros: Fast and efficient for executing trades quickly.

Cons: Can result in slippage, especially during volatile market conditions.

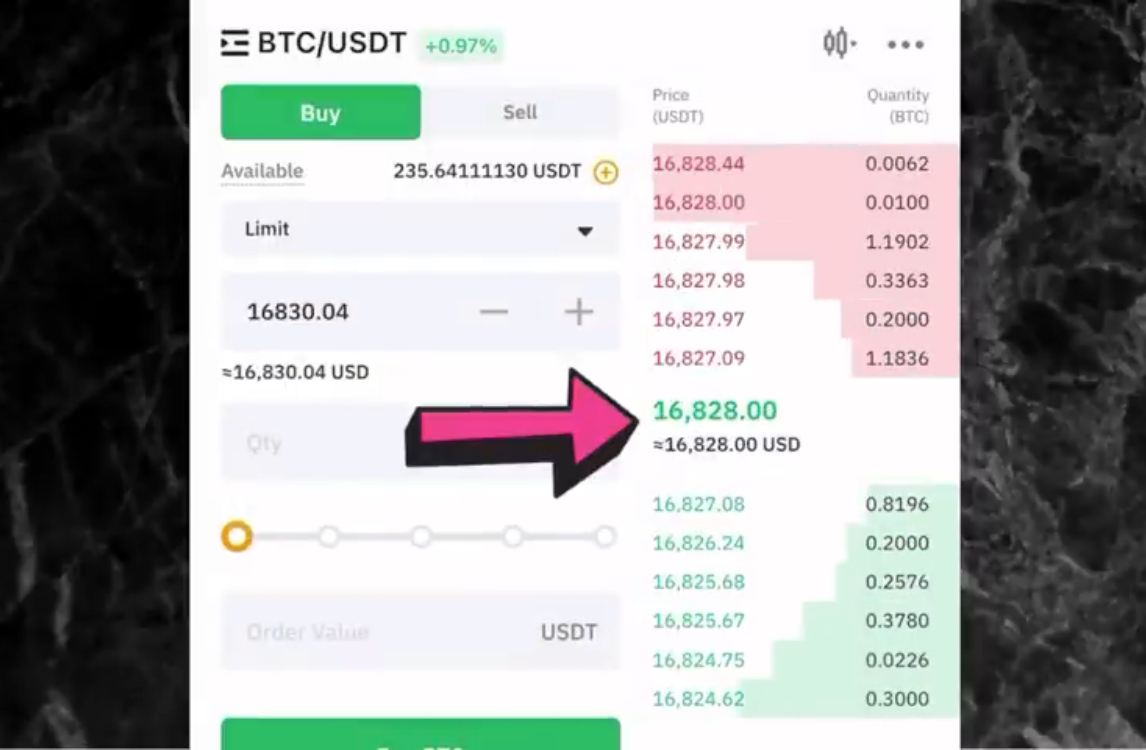

Limit Order

Execution: Buys or sells only when the market price reaches a specified limit price.

Pros: Allows you to control the price at which you enter or exit a trade.

Cons: May not be executed if the market price doesn’t reach the limit price.

Stop Order

Execution: Becomes a market order when the market price reaches a specified stop price.

Pros: Helps protect against losses by automatically selling when the price drops below a certain level.

Cons: May be triggered prematurely during market fluctuations.

Stop-Limit Order

Execution: Becomes a limit order when the market price reaches a specified stop price.

Pros: Provides a degree of price control while protecting against losses.

Cons: May not be executed if the market price doesn’t reach the limit price after the stop price is triggered.

Trailing Stop Order

Execution: A stop order that adjusts its price based on the market price, creating a trailing stop that moves with the price.

Pros: Helps capture profits as the price moves in your favor.

Cons: May not be as effective in volatile markets.

Fill or Kill (FOK) Order

Execution: Requires the entire order to be filled immediately or canceled.

Pros: Ensures that the trade is executed at a specific price.

Cons: May be difficult to fill during low liquidity periods.

Immediate or Cancel (IOC) Order

Execution: Fills as much of the order as possible immediately and cancels the remaining portion.

Pros: Allows for partial fills.

Cons: May not fill the entire order if liquidity is low.

Watch Video to set some basic order time.