House Financial Services Committee Chair Patrick McHenry and House Majority Whip Tom Emmer of Minnesota accused the SEC of “putting its thumb on the scale,” when it comes to airdrops.

The pair sent SEC Chair Gary Gensler a set of questions including how the agency plans to distinguish airdrops from airline miles or credit card points.

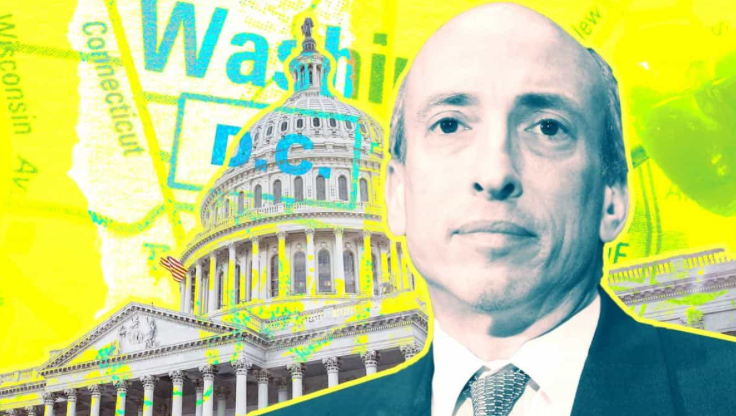

Top Republican lawmakers say they want clear answers on how the U.S. Securities and Exchange Commission views airdrops in the crypto industry.

House Financial Services Committee Chair Patrick McHenry of North Carolina and House Majority Whip Tom Emmer of Minnesota accused the SEC of “putting its thumb on the scale” in a letter sent to its Chair Gary Gensler on Tuesday.

“By creating a hostile regulatory environment, including making assertions about airdrops in various cases and increasing warnings for additional enforcement actions, the SEC is putting its thumb on the scale and precluding American citizens from shaping the next iteration of the internet,” they wrote.

Some crypto startups use airdrops to distribute free tokens in digital asset wallets.

Lawmakers cited cases where the SEC has addressed airdrops, including its case against Tron founder Justin Sun. The agency said airdrops could be considered a “sale or distribution of securities” in a footnote in its 2019 “Framework for ‘Investment Contract’ Analysis of Digital Assets.” Emmer and McHenry say that the developers “have been forced to block Americans” from receiving crypto in an airdrop.

“By prohibiting Americans from participating in airdrops, the SEC is preventing crypto users from fully realizing the benefits of blockchain technology,” Emmer and McHenry wrote.

The pair sent Gensler a set of questions, including how the agency plans to distinguish airdrops from airline miles or credit card points. They said they want a response from Gensler by Sept. 30. The SEC did not immediately respond to a request for comment.

McHenry and Emmer have criticized Gensler over the years on his approach to regulating crypto. Gensler has asserted that most cryptocurrencies are securities and has called on crypto platforms to register with the agency. Meanwhile, McHenry and Emmer have led efforts to pass a crypto market structure bill in the House that divvies jurisdiction of crypto between the SEC and gives new jurisdiction to the Commodity Futures Trading Commission.

The letter comes as the House Financial Services Committee plans to hold a few hearings over the next week, putting a spotlight on the SEC and crypto. On Wednesday, lawmakers will hold a hearing titled “Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets” and another next week on oversight at the agency. All five commissioners will attend the hearing on Sept. 24.