Kiyosaki advocates for investing in gold, silver, and Bitcoin, citing their safety and intrinsic value, while criticizing ETFs for financial system risks.

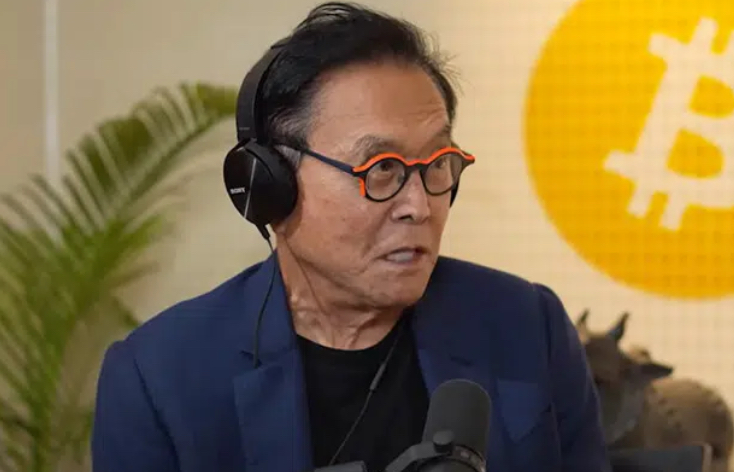

The famous writer Robert Kiyosaki has recently caused controversy among the crypto community calling Bitcoin ETFs “fake investment.”

In his recent social media post, Kiyosaki criticized ETFs not only for Bitcoin but also for gold and silver ETFs stating that they are investments in fake assets.

Kiyosaki insisted on investing in real metals like gold and silver, as well as Bitcoin, asserting their safety and greater intrinsic value compared to ETFs, which Kiyosaki criticized for potential manipulation or dilution by the financial system.

Kiyosaki’s comments come at a time when more and more attention is being paid to the U.S. cryptocurrency ETF market. Even though there were some up and down movements in the recent past, the U. S. Spot Bitcoin ETF received $11.8 million on June 27, while other investment products such as GrayScale’s GBTC recorded outflows.

While Kiyosaki’s critique stems from a suspicion of ETFs, many investors regard these funds as an indirect way to invest in cryptocurrencies. The controversy surrounding ETFs and their function in the crypto space persists as new regulations, such as the possible listing of a U. S. Spot Ethereum ETF, are still in the works.

Also, the latest filing by VanEck to launch a Solana ETF shows that there is more to the blockchain investment than the traditional Bitcoin and Ethereum investments which shows that the ETF market is not stagnant. On the other hand, Bitcoin’s value rose slightly to $61,585 as the market changed its dynamics.

Kiyosaki’s opinions are provocative, and they contribute to the current debates regarding the legitimacy and usefulness of ETFs in the crypto industry, which affects investors’ attitudes and the market.