Former House Speaker calls for stablecoin regulation as Tether’s treasury holdings support the U.S. dollar’s digital stronghold.

Tether reported a massive $4.52 billion profit in the first quarter of the year.

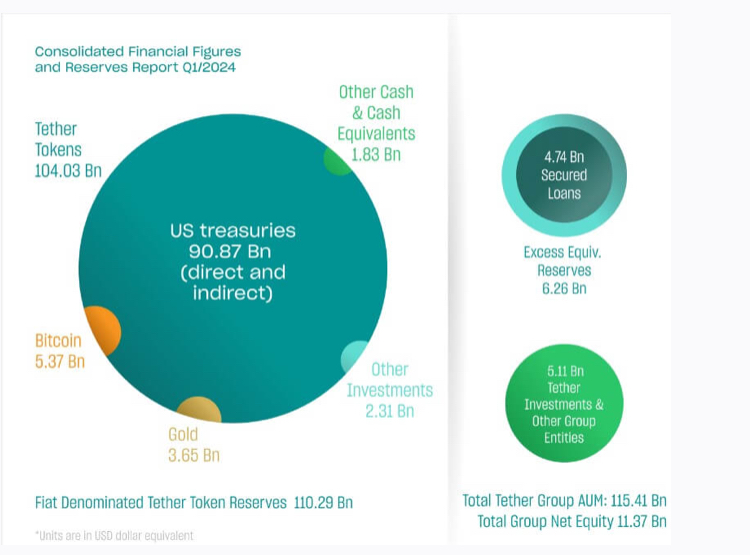

Notably, the stablecoin issuer’s consolidated financial figures revealed that as of March 31, it held a staggering $91 billion in direct and indirect US treasury bill holdings. Meanwhile, the company also holds a substantial $5.4 billion in Bitcoin.

Tether’s Financial Report (Source: Tether)

Tether’s Financial Report (Source: Tether)

Based on the Treasury’s March data, Tether is the 19th largest holder of US treasuries among sovereign nations, nestled between South Korea and Germany.

However, the landscape is shifting as major players like China have offloaded treasuries, dropping from $869 billion to $767 billion over the past year. Simultaneously, Japan, the largest holder with around $1.2 trillion, may need to sell amid a weakening yen.

A video clip shared by Radar on X shows former House Speaker Paul Ryan advocating for stablecoin regulation for two key reasons: increased demand for treasuries and further entrenchment of the dollar into the digitizing digital asset ecosystem.

As stablecoins’ treasury holdings increase, their potential to bolster the U.S. dollar in the digital asset space correspondingly strengthens.