Zone, a Nigerian payment fintech startup that leverages the blockchain, recently raised $8.5 million in a seed funding round. An undisclosed portion of the funds will be allocated to cover costs associated with the trial of Zone’s cross-border payment capabilities in 2025.

Zone to Expand Its Payment Infrastructure

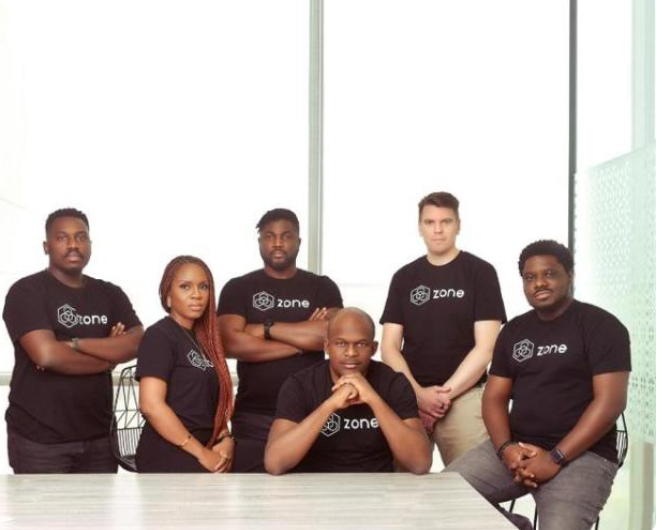

Zone, a blockchain-based Nigerian payments startup, has raised $8.5 million in a seed funding round. The round, which was oversubscribed, was led by Flourish Ventures and TLcom Capital. Other participants in the round include the Digital Currency Group (DCG), Verod-Kepple Africa Ventures (VKAV), Alter Global, and Endeavor Catalyst.

A report indicates that Zone plans to use the raised capital to expand its payment infrastructure and establish connections with more banks and financial service providers. A portion of the funds, which remains undisclosed, will be used to pay for costs associated with the trial of Zone’s cross-border payment capabilities in 2025.

The report further states that Zone aims to become a global payments network. This goal will be realized through the expansion of its presence in Africa. Commenting on the startup’s successful capital raise, Obi Emetarom, the CEO and co-founder of Zone, has expressed appreciation for the investors’ confidence in the startup’s vision.

“The participation of high-quality investors despite the funding drought and the fact that we had more interested investors than we needed, is a sign of trust in the Zone brand and investor excitement about the opportunity to redefine payment infrastructure in Africa,” Emetarom said.

The CEO added that the millions of dollars raised will help Zone accelerate its goal of enabling real-time payments both domestically and across borders.

Ameya Upadhyay, a partner at Flourish Ventures, characterized Zone’s technology — which facilitates direct communication between participants in the payment ecosystem — as a “fundamental leap.” Upadhyay added:

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.”