Nearly one week following its $12.5-billion agreement to acquire Global Infrastructure Partners (GIP), the renowned infrastructure investment fund founded by Nigerian billionaire businessman Adebayo Ogunlesi in 2006, BlackRock, Inc., the world’s largest asset manager, is actively engaging with the Nigerian government.

The Wall Street giant’s team, led by Emily Fletcher, fund manager, and Dennis Kalugin, analyst, recently met with key officials of the Central Bank of Nigeria (CBN) to discuss ongoing financial reforms and Nigeria’s monetary policy outlook.

The discussions, confirmed by the CBN in a statement, involved meetings with Governor Olayemi Cardoso and Deputy Governor for Economic Policy Muhammed Sani Abdullahi. The dialogue focused on ongoing reforms and Nigeria’s monetary policy outlook, reflecting the Wall Street giant’s keen interest in the country’s financial markets.

BlackRock’s bold move: $12.5-billion GIP deal sparks collaborative dialogue with Nigerian financial leaders

The CBN, sharing insights via its official communication platform, disclosed that the BlackRock team’s visit is part of a broader engagement strategy to interact with policymakers and key players in the Nigerian financial markets.

This strategic move comes in the wake of BlackRock’s announcement of its intention to acquire GIP in a deal valued at $12.5 billion, aimed at creating a market-leading, multi-asset class infrastructure investing platform.

The deal involves a total consideration of $3 billion in cash and approximately 12 million shares of BlackRock common stock, valued at $9.5 billion.

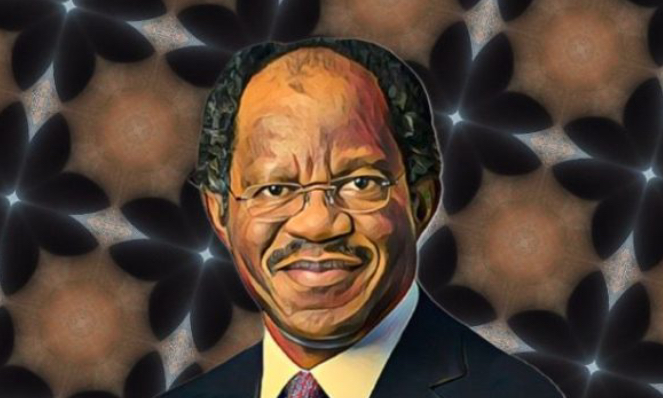

BlackRock’s acquisition elevates Adebayo Ogunlesi to Africa’s billionaire elite with $2.3-billion fortune

Under the leadership of Ogunlesi, GIP has evolved into the world’s largest independent infrastructure manager, boasting an impressive $100 billion in assets under management.

The acquisition by BlackRock propels Ogunlesi into the ranks of Africa’s billionaires, with an estimated fortune of $2.3 billion, according to Bloomberg.

Ogunlesi’s calculated 17.5-percent stake in GIP secures his position among Africa’s top 20 billionaires, adding another chapter to his distinguished career, which began with a pivotal role at Credit Suisse and culminated in co-founding GIP in May 2006.