Gensler emphasizes the importance of new leadership understanding and sticking to existing securities laws for FTX’s success.

Former NYSE President Tom Farley is among the top contenders to acquire FTX’s assets.

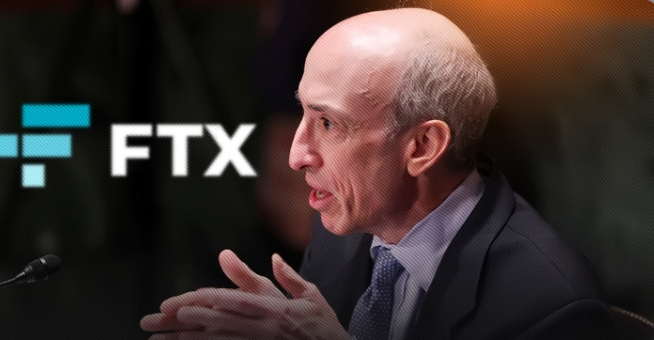

Securities and Exchange Commission (SEC) Chairman Gary Gensler has expressed a cautiously optimistic perspective regarding the potential revival of the defunct cryptocurrency exchange, FTX. Gensler’s remarks came during a discussion at DC Fintech Week, where he underlined that a reinvigorated FTX could succeed if its new leadership operates with a “clear understanding of existing legal frameworks.”

Gensler’s comments were prompted by reports suggesting that Tom Farley, a former president of the New York Stock Exchange, is one of the top contenders among three bidders seeking to acquire the remnants of the bankrupt crypto exchange. The SEC Chair said, “If Tom or anybody else wanted to be in this field, I would say, “Do it within the law.”

Farley, who recently launched his digital asset exchange, Bullish, is now in the running for FTX’s assets in the bankruptcy auction. The other two bidders for FTX are the venture capital company Proof Group and the fintech startup Figure Technologies.

Further, Gensler emphasized the importance of enforcing existing securities laws when considering new regulations for the cryptocurrency industry. He noted that these laws are already robust and comprehensive; they simply require rigorous enforcement.

Sam Bankman Fried Facing Guilty

The backdrop for FTX’s potential resurgence is the recent conviction of its founder, Sam Bankman-Fried, who was found guilty on all seven criminal counts against him, including fraud and money laundering charges. Further, allegations against FTX included the funneling of customer funds to its hedge fund, Alameda Research, which ultimately led to FTX filing for bankruptcy a year ago.

If FTX is successfully rebooted, there is a glimmer of hope for customers who suffered losses during its collapse. They may have the opportunity to recoup some of their investments through ownership stakes or new digital tokens. This innovative approach offers a potential silver lining for those affected by the platform’s downfall.