The author recently identified Bitcoin as a capital appreciator and an insurance policy.

The U.S. stock market collapsed in the wake of a debt limit fight in July 2011.

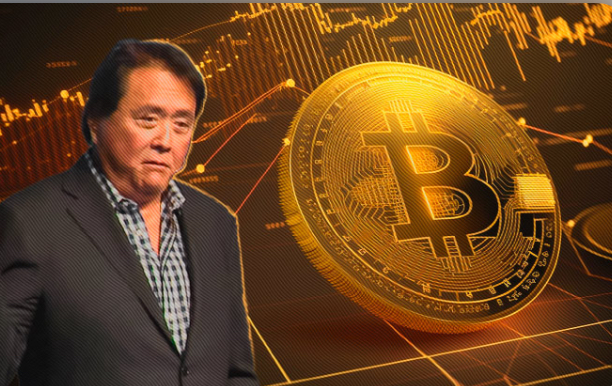

In light of the ongoing negotiations to raise the debt limit before the June 1, 2023 deadline, Rich Dad Poor Dad author Robert Kiyosaki has renewed his advice to invest in gold and Bitcoin. While investing in conventional assets in the financial sector is dangerous due to tighter market circumstances, he recently identified Bitcoin as a capital appreciator and an insurance policy.

He anticipates a ‘crash landing’ and advises investors to protect themselves by purchasing gold, silver, and Bitcoin. Meanwhile, negotiations on raising the debt limit have failed to get up steam before the June 1st, 2023 deadline.

All Eyes on Deadline Extension

The U.S. stock market collapsed in the wake of a debt limit fight in July 2011. Coincidentally, Bitcoin’s value fell by a stunning 61% in the first few years following its debut. The US is already insolvent and has unfunded obligations of over $250 trillion as social security, thus the argument over raising the debt ceiling is a farce, according to the author.

The primary focus during talks to increase the debt ceiling will be to save the country’s credit from going into default. On Wednesday, though, leading Republican Kevin McCarthy suggested that despite disagreements, a compromise on budget cuts was likely to be struck.

Kiyosaki elaborated by saying:

“Politicians debating raising $ 30 trillion US debt limit bad comedy, “kabuki theater.” Facts are: US bankrupt. Unfunded liabilities as Social Security are over $250 trillion.”

Although a stock market crisis is seen to be good for Bitcoin in the long run since it may be favored as a high-risk play against market uncertainty, cryptocurrency market values are still primarily influenced by macroeconomic events.