The exchange CEO wrote on Twitter that all funds are safe

On May 8, outflow data confirmed the largest withdrawal in its history, over 162,000 $BTC has left the exchange, valued at over $4.6 Billion.

On May 8, Binance, the world’s biggest cryptocurrency exchange, paused bitcoin withdrawals for several hours, attributing the delay to high volumes and a spike in processing fees, before eventually processing them at a higher cost.

Over Sunday night and Monday morning, the largest crypto exchange in the world suspended bitcoin withdrawals, stating that there was an excess of pending transactions due to insufficient incentives offered to miners to record the trades on the blockchain.

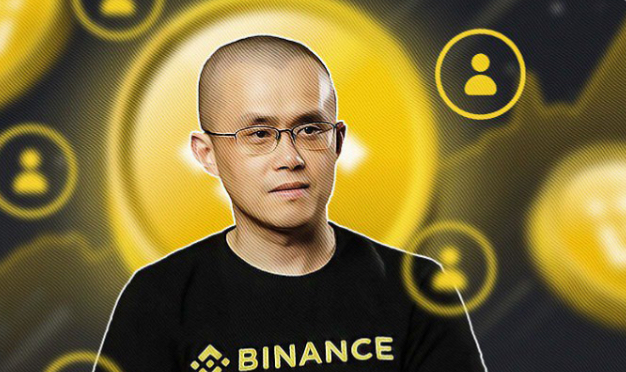

Taking to Twitter, Binance’s CEO Changpeng Zhao, CZ, wrote, “there is some FUD about BTC withdrawal issues. Here is why. Bitcoin network fees are fluctuating, 18x in a month.” CZ added a screenshot of an article by TheBlockBeats.info. That describes full-net handling fees of Bitcoin increasing nearly 18x from a month ago.

In addition, Binance said in a tweet;

Our set fees did not anticipate the recent surge in (bitcoin) network gas fees. We’re replacing the pending bictoin withdrawal transactions with a higher fee so that they get picked up by mining pools.

Also, they stated, we need more information as to what has led to the large withdrawals […] to prevent a similar recurrence […] our fees have been adjusted.”

Binance had halted deposits and withdrawals in March, citing technical difficulties. According to CoinMarketCap, which is owned by Binance Holdings Limited, the 24-hour trading volume on Binance was $6.9 billion. That is more than eight times its biggest rival, Coinbase, founded in 2012 by Brian Armstrong and Fred Ehrsam. Also, this past March, Binance suspended deposits and withdraws due to a “bug on a trailing stop order.”