The firm declared bankruptcy since it did not have sufficient reserves of client funds.

Sirer said he is kept up by the prospect of how far SBF pushed the industry back.

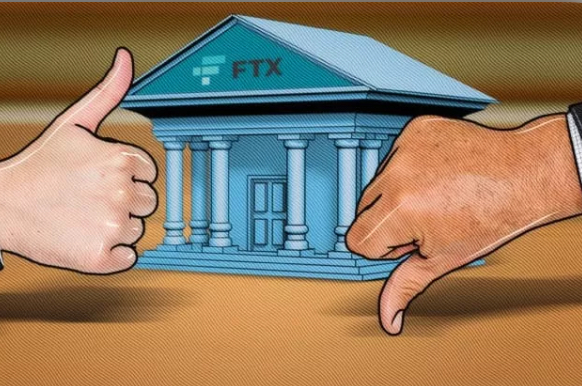

The collapse of FTX last autumn was a bad omen for the crypto sector, damaging the young industry’s credibility and trustworthiness. And this is a huge pushback, says Emin Gün Sirer, CEO and founder of Ava Labs.

Sirer stated:

“The damage that Sam did is immeasurable. All of that goodwill that we built over many, many years of hard work is just usurped by some guy who comes in and puts on this boy genius act.”

According to Sirer, he has seen the digital assets business “blossom from nothing” into its current state. Moreover, he claimed that as a computer science professor at Cornell University. He had made significant efforts to promote blockchain education by informing lawmakers and holding seminars.

Pushed the Industry Back

Sirer said he is kept up by the prospect of how far Bankman-Fried pushed the industry back, and how the changing tides in regulatory circles might be extremely awful for anyone linked with crypto.

Sam Bankman-Fried, the 30-year-old founder of FTX, rose to prominence when digital asset values plummeted last summer. The entrepreneur was praised for his efforts to rescue struggling cryptocurrency companies.

The fall of FTX in November of last year, however, caused a public perception shift against Bankman-Fried. The firm declared bankruptcy since it did not have sufficient reserves of client funds to satisfy withdrawals and so had to close.

Bankman-Fried was subsequently detained and slapped with several charges for suspected misappropriation of billions of dollars in client funds, including fraud and money laundering. He has pled not guilty to the counts against him, and more were added against him only last week.