Nigeria urged citizens to use the eNaira and other channels by the central bank.

Who breach the limits imposed by the government will be charged.

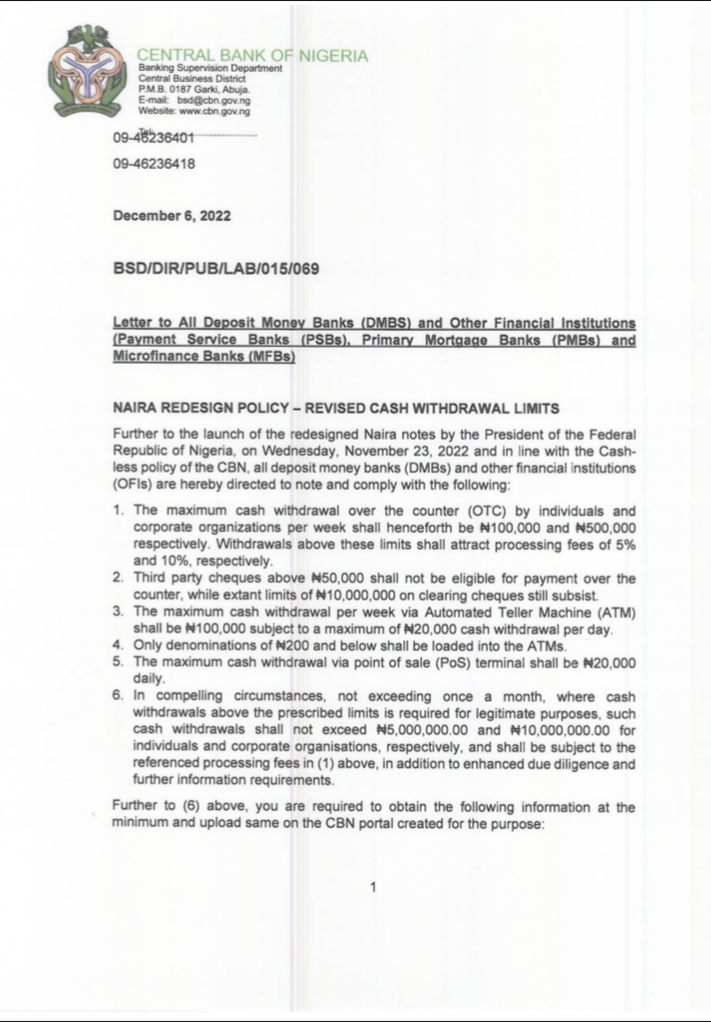

Nigeria has significantly reduced the daily cap on cash withdrawals from ATMs to encourage the usage of ‘eNaira,’ the Central Bank of Nigeria’s digital currency (CBDC). Individuals and organizations, who violate the government-imposed restrictions will be penalized between 5% and 10%.

To enhance digital currency circulation the central bank restriction is knocked on each withdrawal, whether they are done at an ATM or a bank. Also, a 5% charge will be applied to people who withdraw $45 from an ATM and then attempt to withdraw money from a bank on the same day.

Nigeria’s First Move to Improve Digital Currency Adoption

The eNaira adoption levels have been weak since its first launch on the 25th of October 2021. 0.5% of the population was estimated to have used the eNaira as of October 25, a year after its inception, which indicates that the Central Bank of Nigeria has difficulty enticing its population to adopt the CBDC.

However, the move is the most recent in a series of directives issued by central banks to reduce the usage of cash and promote digital currencies. According to a December 6, 2022, memorandum from the Central Bank of Nigeria, the daily limit on customer withdrawals has been reduced from150,000 ($334) naira to 20,000 ($44.91) naira.

Also, the weekly cash withdrawals from banks are limited to 100,000 ($225) naira for private customers and 500,000 ($1,122) naira for corporate customers, as per the Central Bank of Nigeria report. In addition, Naira is planning to release new banknotes as 85% of the currency in circulation was held outside of banks, and nearly 40 million adults lack a bank account.

I seriously love your site.. Great colors & theme. Did you create this amazing site yourself? Please reply back as I’m attempting to create my very own site and would love to learn where you got this from or just what the theme is named. Thanks!