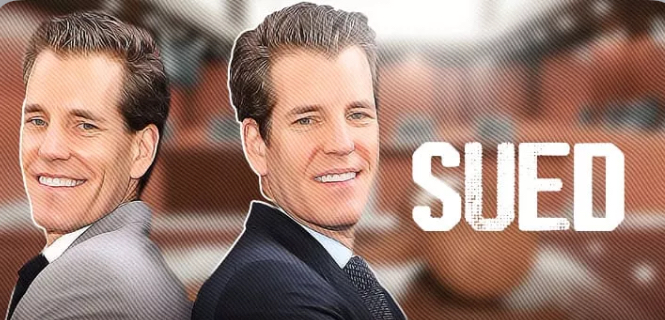

The investors have claimed that the Winklevoss twins committed fraud.

Gemini Earn Trust offered returns of up to 8% to its backers.

As a result of the ongoing liquidity situation at Genesis Global, which is a cryptocurrency lender, Gemini Trust Co. has become a scapegoat. Investors have filed a lawsuit against Gemini’s co-founders Tyler and Cameron Winklevoss. Alleging that they were offered interest-bearing accounts by the cryptocurrency exchange that were not properly registered as securities.

The investors have claimed that the Winklevoss twins committed fraud and violated the Exchange Act. In addition, on Tuesday, December 27th, they presented a class action case to a federal judge in Manhattan.

Products Not Registered as Securities

Gemini Earn Trust, a proprietary offering from the cryptocurrency trading platform, offered returns of up to 8% to its backers. However, last month Gemini unexpectedly suspended withdrawals for its Earn Product as its primary partner, Genesis Global, had serious liquidity difficulty in the wake of the fallout from the bankruptcy of crypto exchange FTX.

The investors said in a recent lawsuit:

Gemini “refused to honor any further investor redemptions, effectively wiping out all investors who still had holdings in the program”.

They went on to say that if the products had been registered as securities, investors would have received timely disclosures that would have allowed them to make more informed risk assessments.

In light of the fresh information, the cryptocurrency trading platform Gemini has taken swift action. On December 23 of last week, Gemini’s website displayed a statement elaborating on the company’s “utmost” urgency.

Genesis promised that “we will continue to work on your behalf around the clock through the holidays” in an effort to remedy the liquidity problem.