Risk Harbor and Astroport (ASTRO), dropped by more than 93% and 99%.

Over $31 billion has been lost in these protocols since then.

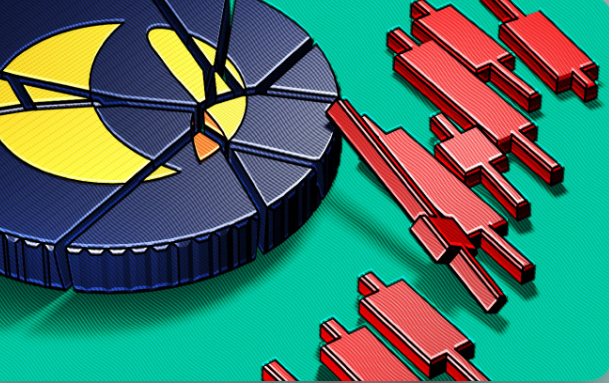

Investors’ worst fears had come true with LUNA’s demise, as the whole cryptocurrency ecosystem took a severe hit. While the LUNA tragedy had received the most attention, the DeFi protocols on Terra were also wiped off significant market value from the April peak.

The Terra DeFi Apps had a TVL of $31.21 billion on April 5, when LUNA hit an all-time high. According to the numbers, on April 6th, TVL in Terra Defi applications peaked at $31.35 billion. Over $31 billion has been lost in these protocols since then. According to the numbers, every single Terra DeFi protocol had a severe drop of between 93% and 100% in only one month.

Significant Massacre

The price of Anchor (ANC), the currency that makes up the bulk of Terra’s TVL, had fallen by more than 69% and by more than 99% during the bloodshed month. The Terra TVL rankings for second and third place, Risk Harbor and Astroport (ASTRO), dropped by more than 93% and 99%, respectively.

Mars Protocol (MARS), Pylon Protocol (MINE), Aperture Finance (APER), and Kujira (KUJI) all dropped by approximately 99% in a month, while Terraswap, Spectrum Protocol (SPEC), and White Whale (WHALE) all fell by around 98%.

Anchor is a borrowing and lending system that offers a steady, high-interest rate of up to 19.5% on deposits of stablecoin to cryptocurrency natives, fintech businesses, and investors.

When the TerraUSD (UST) broke its 1:1 peg to the US dollar in the context of generally weakening markets, there was a horrific bloodbath in LUNA and its DeFi protocol. This caused the cryptocurrency market to crash, with even Bitcoin, the market leader, feeling the effects.