Q2 investment memo showed a 34% decrease in transaction activity.

Besides Web3 infrastructure, the company spent aggressively on blockchain gaming.

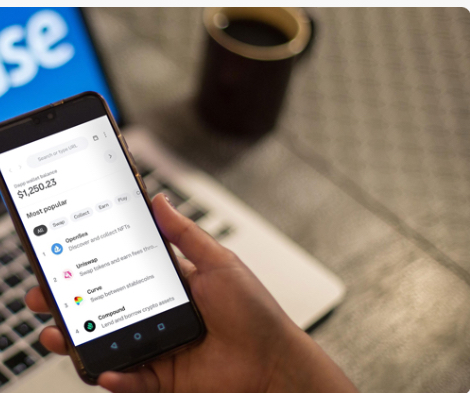

According to Coinbase Ventures’ Q2 report, overall deal activity fell in tandem with the prevailing gloomy tone in the market. However, the firm’s investment thesis on infrastructure projects that exhibit genuine usefulness as well as the expanding Web3 gaming industry was unaffected by the adverse market conditions.

On Thursday, Coinbase Ventures released its Q2 investment memo, which showed a 34% decrease in transaction activity from the previous quarter, but a 68% increase year-over-year. It was the first financing decrease since the second quarter of 2019 that the investment giant saw in the larger venture sector.

DeFi Preferred Over Centralized Finance

High volatility has caused investors to “rethink or put their rounds on pause” and only gamble on startups that can “show the growth needed to justify a new round,” according to Coinbase’s investment arm.

According to Coinbase Ventures’ concentration on Web3/protocol infrastructure and Platform & Developer Tool (38 percent and 21 percent of the overall investment, respectively), the company continues to invest in initiatives that have genuine use despite the grim macro climate.

Besides Web3 infrastructure, the company spent aggressively on blockchain gaming as Web2 developers started to embrace the new category. CV was confident that Axie Infinity’s fall in user activity would not have a negative impact on the industry since it raised $2.6 billion in Q2 despite the market’s poor circumstances.

Coinbase Ventures showed a preference for Solana in layer one investments, as the number of developers utilizing its coding language, Rust, grew. There has been a noticeable increase in the number of EVM developers switching to Solana. Centralized lenders’ risky practices recently caused the whole industry to collapse due to their methods, thus Ventures decided to invest in viable DeFi protocols instead.